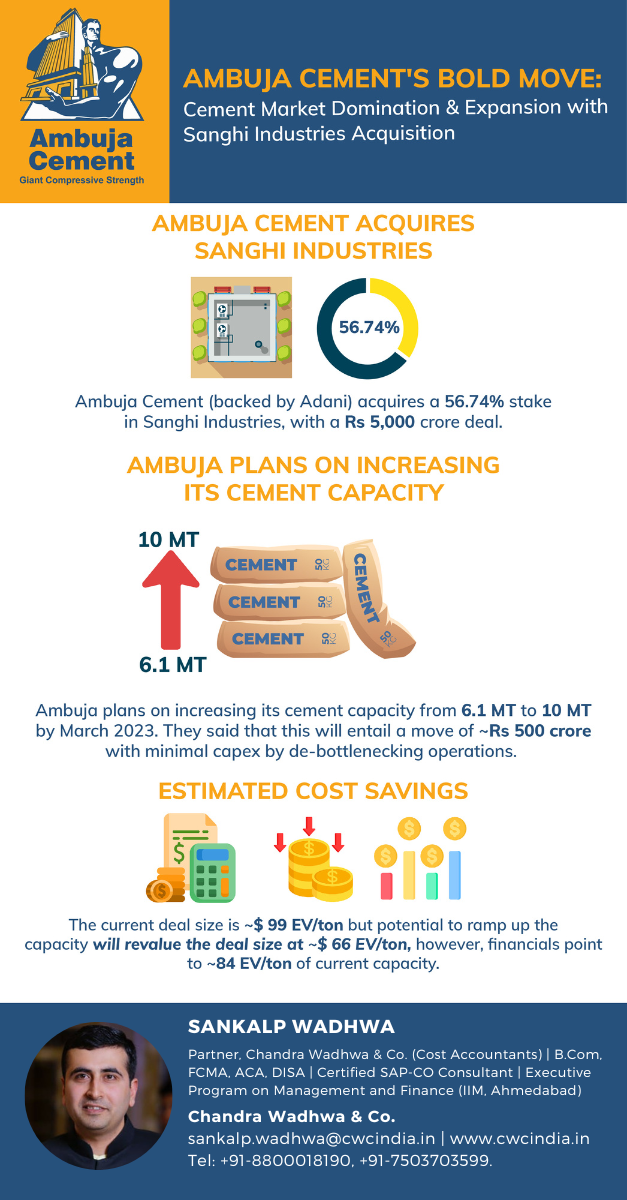

--- Ambuja Cement acquires a 56.74% stake in Sanghi Industries, with a Rs 5,000 crore deal.

--- Ambuja plans on increasing its cement capacity from 6.1 MT to 10 MT by March 2023. Adani said that this will entail a move of ~Rs 500 crore.

-> 6.1 MMTPA Cement Production Capacity

-> 6.6 MMTPA Clinker Production Capacity

-> Access to limestone reserves of ~1 Bn. MT

-> Estimated Cost Savings: The current deal size is ~$ 99 EV/ton but potential to ramp up the capacity with minimal capex by de-bottlenecking operations ~Rs. 500 Cr. This will revalue the deal size at ~$ 66 EV/ton, however, financials point to ~84 EV/ton of current capacity.

The Impact:

- Value Enhancement: The potential synergies from the acquisition may lead to improved financial performance, potentially boosting shareholder value over time.

- Increased Competition: Competing cement manufacturers could face heightened competition from Ambuja Cement with enhanced capacity and cost-efficiency.

- Pricing Pressure: Prospective increases in production capacity could result in competitive pricing strategies thereby warranting competitors to adjust their costing/pricing models to stay in the race.

Country: India 🇮🇳

Company: Sanghi Industries Limited

Industry: Cement

Cost Element: Plant and Machinery

Nature: Capex

Cost Classification: CWIP + Fixed Assets

Source: August 3, 2023 | ETNOW |

CONTACT US

Reach us if you have any concerns regarding cost management accounting issues in your organization.

SANKALP WADHWA

Partner, Chandra Wadhwa & Co. (Cost Accountants) | B.Com, FCMA, ACA, DISA | Certified SAP-CO Consultant | Executive Program on Management and Finance (IIM, Ahmedabad)

Address: 1305 & 1306, Vijaya Building, 17, Barakhamba Road, New Delhi - 110001, India Mail: sankalp.wadhwa@cwcindia.in

Tel: +91-8800018190, +91-7503703599.

Website: www.cwcindia.in

Comments